The Technical Landscape of Bitcoin Layer 2 Smart Contracts

The Bitcoin blockchain’s launch in 2009 was a transformative moment — allowing pseudonymous transactions to take place instantly and across borders in minutes.

But as we’ve seen adoption increase over recent years, this network’s limitations have also become painfully clear. A lack of smart contract functionality has made it impossible to build decentralized apps on top of this blockchain. And given each Bitcoin block can only hold 1MB of data, scalability is another concern — with fees surging through the roof at peak times.

Layer 2 networks are helping to tackle these downsides and allow the world’s biggest blockchain to reach its full potential. Not only are they helping to free up much-needed capacity on the mainnet, but they’re also delivering exciting new use cases — ushering in a wave of advanced DeFi platforms that leverage Bitcoin’s security.

In this article, we’re going to roll up our sleeves and get a little technical — looking under the hood to understand more about how Layer 2 smart contracts work.

The Fundamentals of Bitcoin Layer 2 Solutions

Layer 2 networks have a simple objective: making Bitcoin accessible to everyone. This could be in the form of speeding up transactions, making them cheaper, increasing privacy, or building infrastructure that allows this blockchain to offer the types of dApps and smart contracts seen on Ethereum.

They’re a necessary tool in addressing what’s known as “the blockchain trilemma.” The concept’s pretty simple to understand: security, scalability, and decentralization are all key attributes that Bitcoin strives for, but focusing on one comes at the expense of the other two.

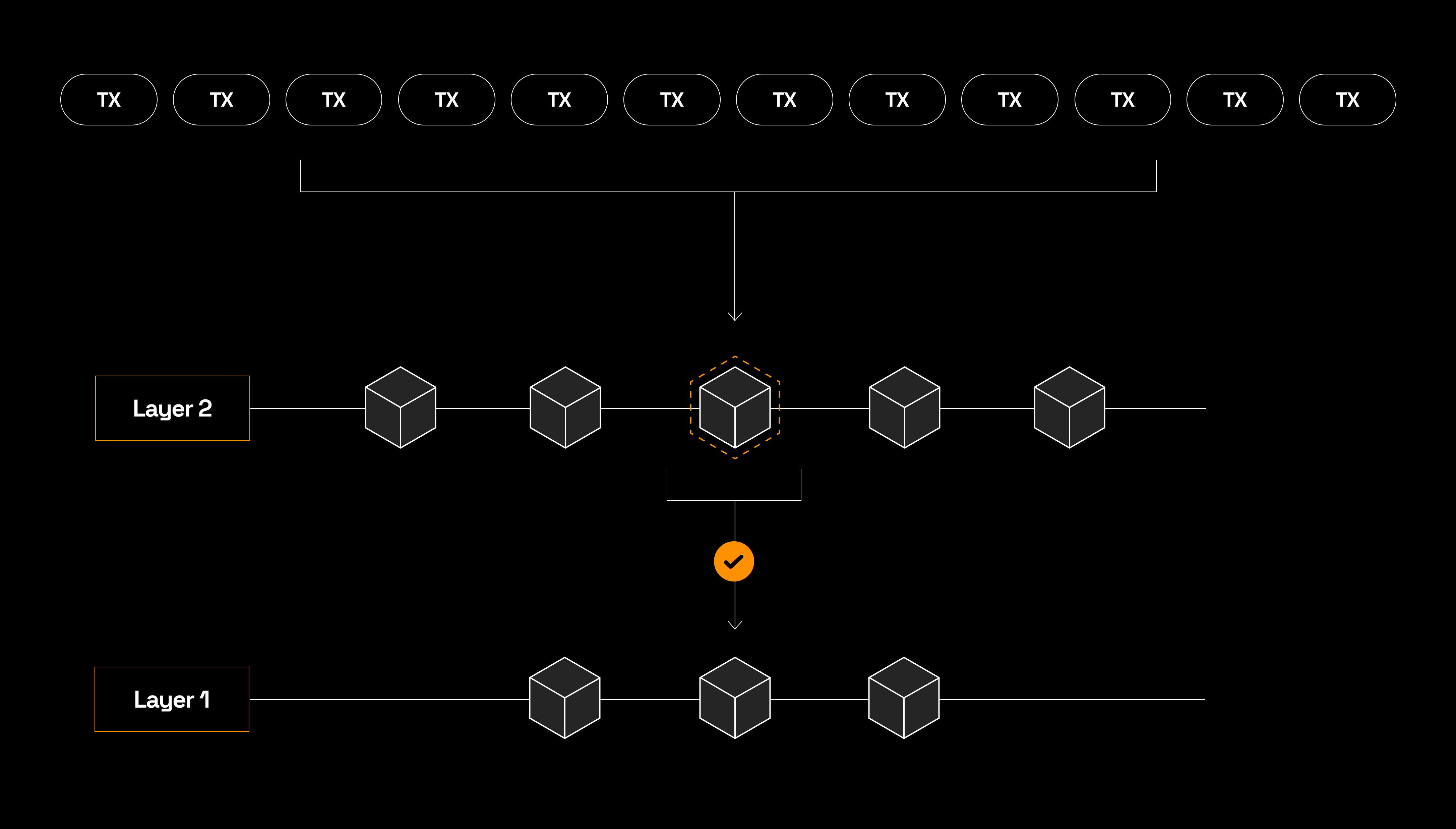

As the name suggests, Layer 2s sit on top of the Bitcoin blockchain — expanding the mainnet’s functionality while simultaneously reducing congestion.

There are three main technologies that make this possible: state channels, rollups, and sidechains.

What Are State Channels?

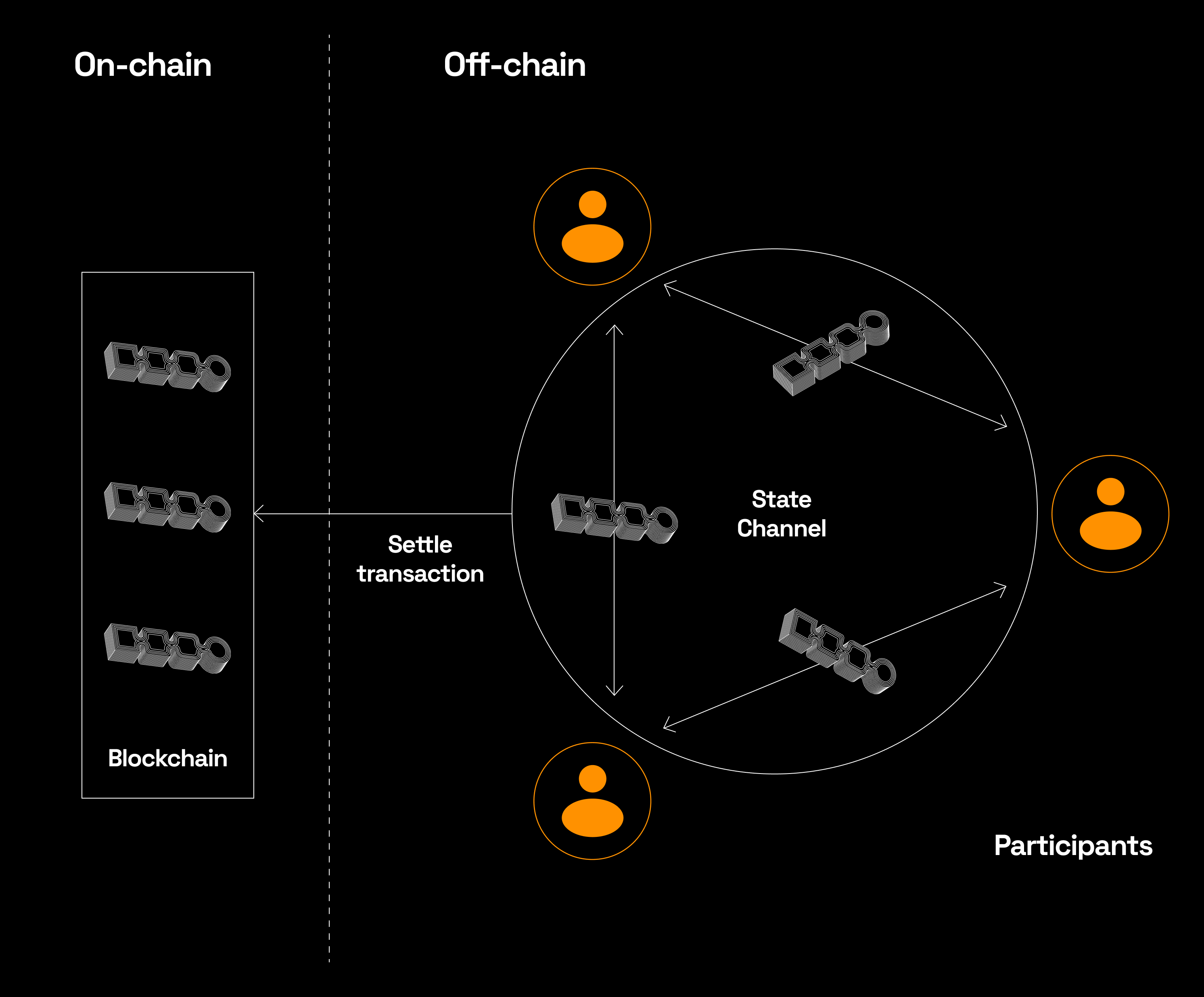

Kicking off our roundup of Layer 2 scaling solutions, let’s take a look at state channels. In essence, they allow transactions to take place off-chain — and when it comes to Bitcoin, the Lightning Network is a really good example.

Let’s imagine Kate wants to send BTC to David, but doesn’t want to pay gas fees or wait a long time for confirmation. Both parties would set up a payment channel, which means transfers aren’t broadcast to the mainnet. Only when this channel is closed would the final balances be submitted to the blockchain — enhancing privacy while alleviating pressure.

Both Kate and David combine their keys to establish a multi-signature (multi-sig) contract, and timelocks may be in place to ensure BTC can only be spent over a particular period. Off-chain transactions can be taken on-chain at any point, allowing the mainnet to resolve disputes.

One of the most potent use cases for state channels relates to how they can be used for micropayments and tipping — meaning a small number of sats can be sent to someone else relatively inexpensively.

What Are Rollups?

Initially a concept put to the test on Ethereum, rollups involve executing transactions off-chain, bundling them together, and then posting the data to the mainnet. In real-world terms, this is equivalent to using a small amount of space very wisely — and managing to cram even more clothes into an already bulging suitcase.

Optimistic Rollups are based on the assumption that all transactions are genuine unless one of them is challenged and proven to be fraudulent. ZK-Rollups work in completely the opposite way — as here, the starting assumption is that they’re all false. To this end, zero-knowledge cryptography is used to verify that a transaction is genuine, without disclosing any specific details about the nature of the transfer. It’s like being able to prove you’re over the age of 18, without revealing a date of birth.

Compression techniques are used to ensure that transactions take up a lot less space — with full details stored in witness space, which is detached from the base block.

As well as increasing transaction throughput while driving costs down, rollups help to maintain decentralization as dApps and DeFi platforms are scaled up. However, limitations in Bitcoin’s scripting language mean there’s some work to be done before they reach their full potential.

Read about the difference between optimistic and ZK rollups in this detailed article.

What Are Sidechains?

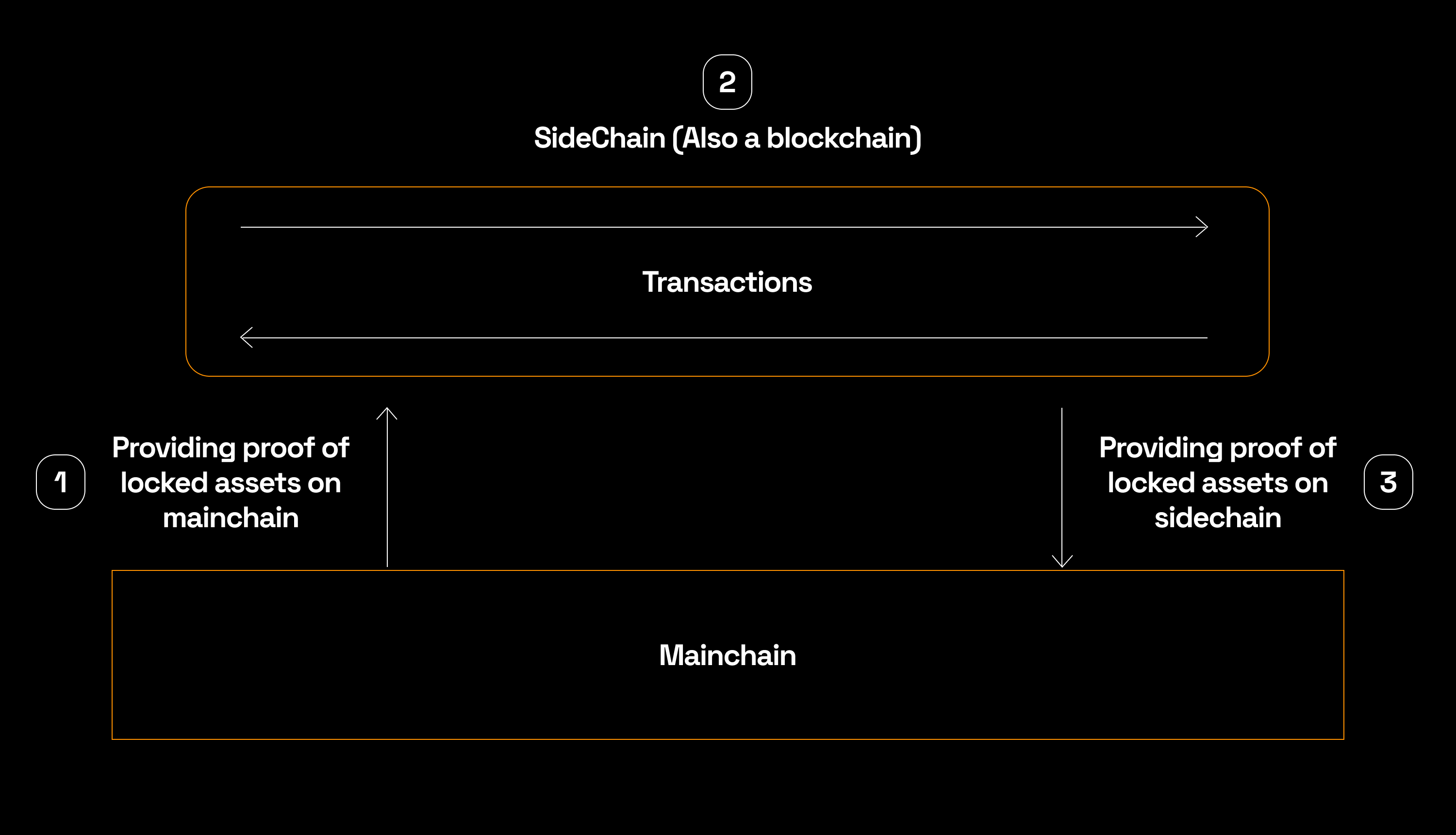

Put simply, a sidechain is an entirely separate blockchain that connects to the mainnet through a two-way peg — allowing assets to be securely transferred between both networks. While sidechains are often secured by the Bitcoin network, through processes such as merged mining, they often have their own consensus mechanisms. This allows the BTC community to benefit from new features, without requiring any alterations to the mainnet.

Sidechains can be regarded as true Bitcoin Layer 2s because they don’t seek to compete with BTC or undermine it. Instead, such blockchains drive functionality and scalability — opening the door to a constellation of dApps that otherwise wouldn’t have been possible. This added utility will prove especially useful as excitement grows around the tokenization of real-world assets, with estimates from Standard Chartered suggesting this will be a $34 trillion market by 2034.

Smart Contract Capabilities on Layer 2

Sidechains like Rootstock supercharge programmability by allowing complicated smart contracts to be rolled out on top of the Bitcoin blockchain for the first time.

Whereas Bitcoin’s scripting language can only be used for specific purposes, Rootstock delivers Turing-complete smart contracts that are fully compatible with the Ethereum Virtual Machine.

Not only does this mean that vibrant dApps, NFT collections, and marketplaces can now benefit from Bitcoin’s security, but it also offers a degree of familiarity for developers who are deeply accustomed to coding using Solidity. Given how many applications require fast finality times to achieve the best user experience possible, this could serve as a silver bullet for adoption.

This sidechain also takes advantage of Bitcoin’s security by enabling its miners to mine Rootstock blocks simultaneously for free — increasing their block reward in the process.

Use Cases and Applications

Dozens of dApps and protocols are now live on Rootstock that wouldn’t have been possible through Bitcoin’s Layer 1 infrastructure.

BTC holders can now benefit from a comprehensive suite of DeFi services — including lending and borrowing, atomic swaps, as well as decentralized exchanges.

And while the likes of Ethereum and Solana have long been associated with non-fungible tokens, Layer 2 smart contracts now mean NFTs and Runes can be created, traded and managed within Bitcoin’s ecosystem for the first time.

From identity verification to decentralized data storage, and from automated smart contract execution to remittances, advanced applications are being continually added to Rootstock’s ecosystem — fulfilling a vision of “Everyday DeFi,” where anyone around the world can finally benefit from the financial inclusion they deserve.

Future Prospects and Innovations

While there’s a lot to be bullish about, there are challenges that Bitcoin Layer 2 solutions are still working to overcome. Particular efforts are focused on ensuring that such networks don’t lead to increased centralization while championing simplicity for users.

As institutional interest in BTC shows no sign of abating, Layer 2s could also play a starring role in creating a lasting bridge to the traditional finance sector — with interoperability a key focus as work continues to reduce fragmentation among blockchains.

Do you have any thoughts on what the effect of Layer 2 solutions will be on Bitcoin? Join the conversation on Discord.