Bitcoin Runes Explained: What to Know About Bitcoin’s Fungible Token Standard

Beyond the breathless enthusiasm surrounding Bitcoin’s halving, there was another new innovation that came to life on the OG blockchain: Runes.

Simply put, Runes is a new protocol standard simplifying the creation of fungible tokens on the Bitcoin blockchain. This provides Bitcoin with an additional token-issuance mechanism, bringing with it a set of new use cases.

Here, we’re going to explore why there’s so much excitement surrounding Runes, how they work, and what sets them apart from the BRC-20 tokens already in existence.

What are Runes?

Runes is a protocol developed by Casey Rodarmor that allows new tokens to be established on the Bitcoin blockchain. In some ways, this is similar to the ERC-20 token standard, which led to the creation of everything from Tether to Shiba Inu.

When he started working on this project back in September 2023, Rodarmor admitted that he wasn’t sure whether this was a wise move: “Fungible tokens are 99.9% scams and memes. However, they don’t appear to be going away any time soon, similar to the way in which casinos don’t appear to be going away any time soon.”

Other protocols that allow fungible tokens to be rolled out on Bitcoin do exist — but in Rodarmor’s view, many of them are incredibly complicated to use and cause eye-watering congestion on the blockchain. On balance, he decided Runes was worth creating because it “might bring significant transaction fee revenue, developer mindshare and users to Bitcoin.” Given how miners are now being paid a lot less for keeping the network secure, this could be a good thing.

Potential use cases of Runes

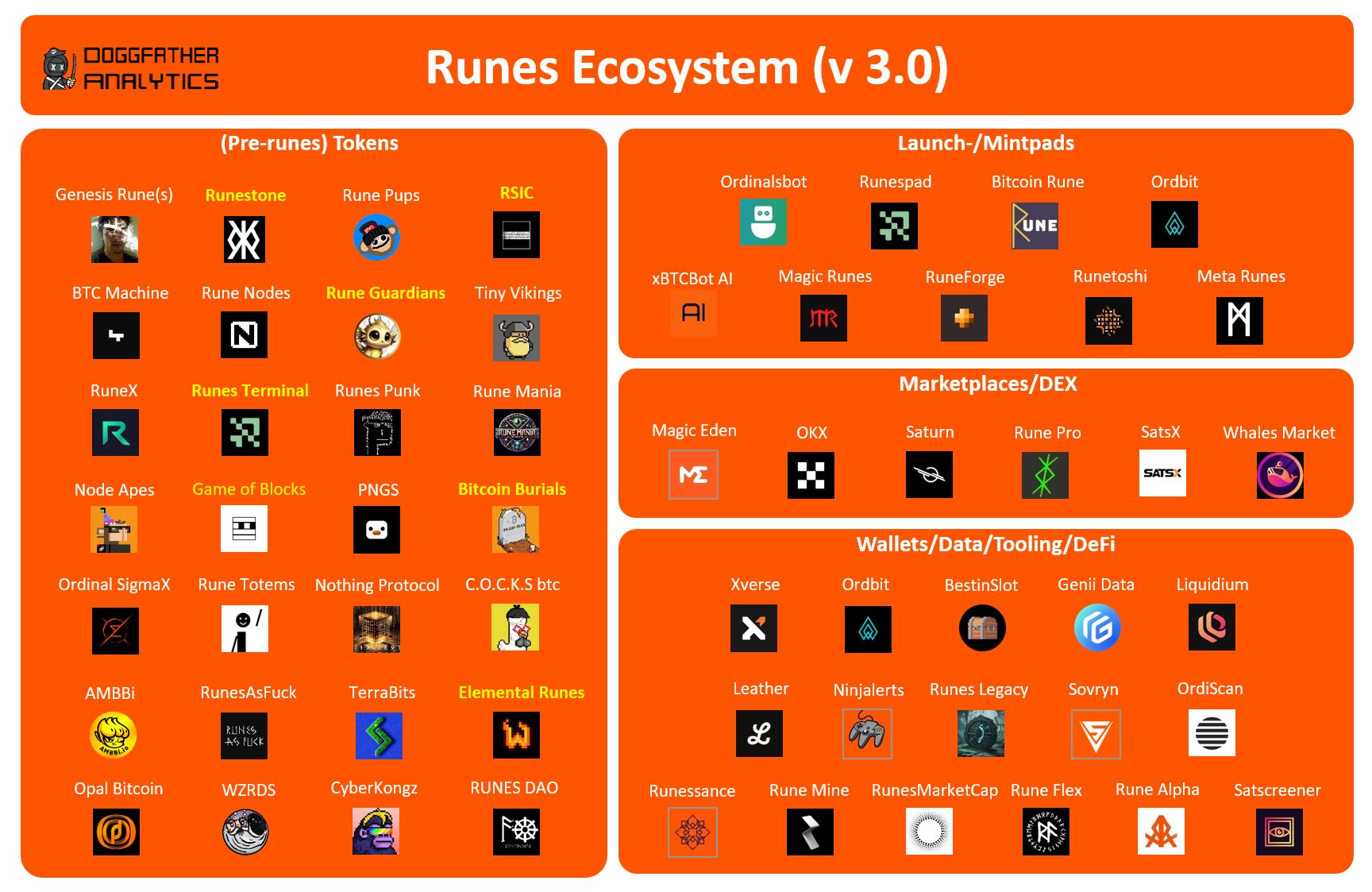

As well as potentially increasing adoption, we’re already starting to see a new ecosystem for Runes be established in real-time — complete with launchpads, decentralized marketplaces, and dedicated DeFi wallets.

And despite Runes being only a few days old, some tokens have already witnessed a surge in demand. Unsurprisingly, the biggest one is dog-themed. With a price of 5.26 sats ($0.003) and a supply of 100 billion, DOG•GO•TO•THE•MOON tops the list with a market cap of $335 million.

How do Runes work?

Runes use Bitcoin’s Unspent Transaction Output (UTXO) model, which means that they benefit from the security measures that underpin the mainnet — and have safeguards in place to prevent tokens from being double spent.

To prevent vast amounts of data from overwhelming the blockchain — which leads to longer confirmation times and astronomical transaction fees — Runes data is stored within the OP_RETURN output. This data includes everything from the token’s name and symbol to supply and how divisible it is.

Runes vs. BRC-20

By contrast, creating tokens using BRC-20 standard is much more expensive, and ultimately results in small and redundant UTXOs congesting the network whenever tokens are burned or minted.

Franklin Templeton recently compared this to “a processing plant, where during the operations there is a lot of waste or junk left over that has no use case.”

Other benefits of Runes include the fact that they’re fully compatible with the Lightning Network, don’t depend on off-chain data, and add a layer of privacy because of how data is concealed within UTXOs.

Put another way, the Runes protocol has been specifically designed for the creation of fungible tokens, whereas BRC-20s inefficiently use existing infrastructure.

Source: Runes Protocol Integration | RUNodE

It’s still early…

Runes are set to dominate the discussion among Bitcoiners in the coming weeks and months — but it’s important to stress that the technology underpinning it is very new, and the value of newly created tokens can fluctuate dramatically.

As Casey Rodarmor says himself, his creation could entice users away from less efficient protocols, but he added: “On the other hand, the world of fungible tokens is a near totally irredeemable pit of deceit and avarice, so it might be a wash.”

Do you have any thoughts on what the effect of Runes will be on Bitcoin? Join the conversation on Discord.