Rootstock’s Rise in Bitcoin L2 Space: Key Insights from Messari Research

Messari, one of the most respected research firms in the crypto space, has released a new and in-depth report shedding light on Rootstock.

As one of the oldest and largest Bitcoin sidechains, Rootstock offers developers a way to build EVM-compatible decentralized applications (dApps) while keeping Bitcoin at the core. This article breaks down the essential insights from the report, from Rootstock’s unique value proposition to its future growth opportunities.

Key Highlights from the Messari Report:

- Rootstock is now leveraging over 60% of Bitcoin’s total hashrate, making it one of the most secure Bitcoin sidechains in existence.

- Rootstock’s TVL has seen significant growth, growing over 107% over a year ($77M to $160.3M)

- Over the past year, Rootstock transaction fees have remained much lower than the average daily transaction fees on the Bitcoin blockchain, averaging approximately 10% of Bitcoin’s gas fees.

- Messari credits RootstockLab’s partnership with Fairgate and the development of BitVMX, an innovative off-chain computation solution, as critical to the sidechain’s continued expansion and future competitiveness.

Why Rootstock Matters: Empowering Bitcoin with Programmability

Analyst Andrew Yang notes Rootstock’s stature as one of Bitcoin’s oldest and biggest sidechains, while highlighting why this network is so necessary: BTC doesn’t support arbitrary programmability, leaving developers with no choice but to build on other networks.

By contrast, Rootstock has offered EVM-compatible smart contracts for more than seven years — meaning dApps already built on Ethereum can be deployed within its ecosystem. This is significant given 87% of blockchain developers already work on at least one EVM chain.

As the report explains, all of this is also achieved without a native token that competes directly with Bitcoin. Instead, RBTC supercharges its utility by being pegged on a 1:1 basis with the biggest cryptocurrency on the planet — and enabling BTC owners to experience DeFi.

Capitalizing Bitcoin Security: Merged Mining

Messari notes that the technology used to secure Rootstock is interesting in its own right, given it has a merged mining consensus mechanism. This means BTC miners can validate Rootstock blocks simultaneously, and increase the rewards they receive in the process. Hot on the heels of April’s halving, this is especially significant.

“Rootstock has been able to secure an average of over 61% of the total Bitcoin hashrate,” Yang writes. “Presently, Rootstock is in its mature phase, leveraging a significant portion of the Bitcoin network’s hashing power to enhance its security.”

Faster Transactions and Lower Fees

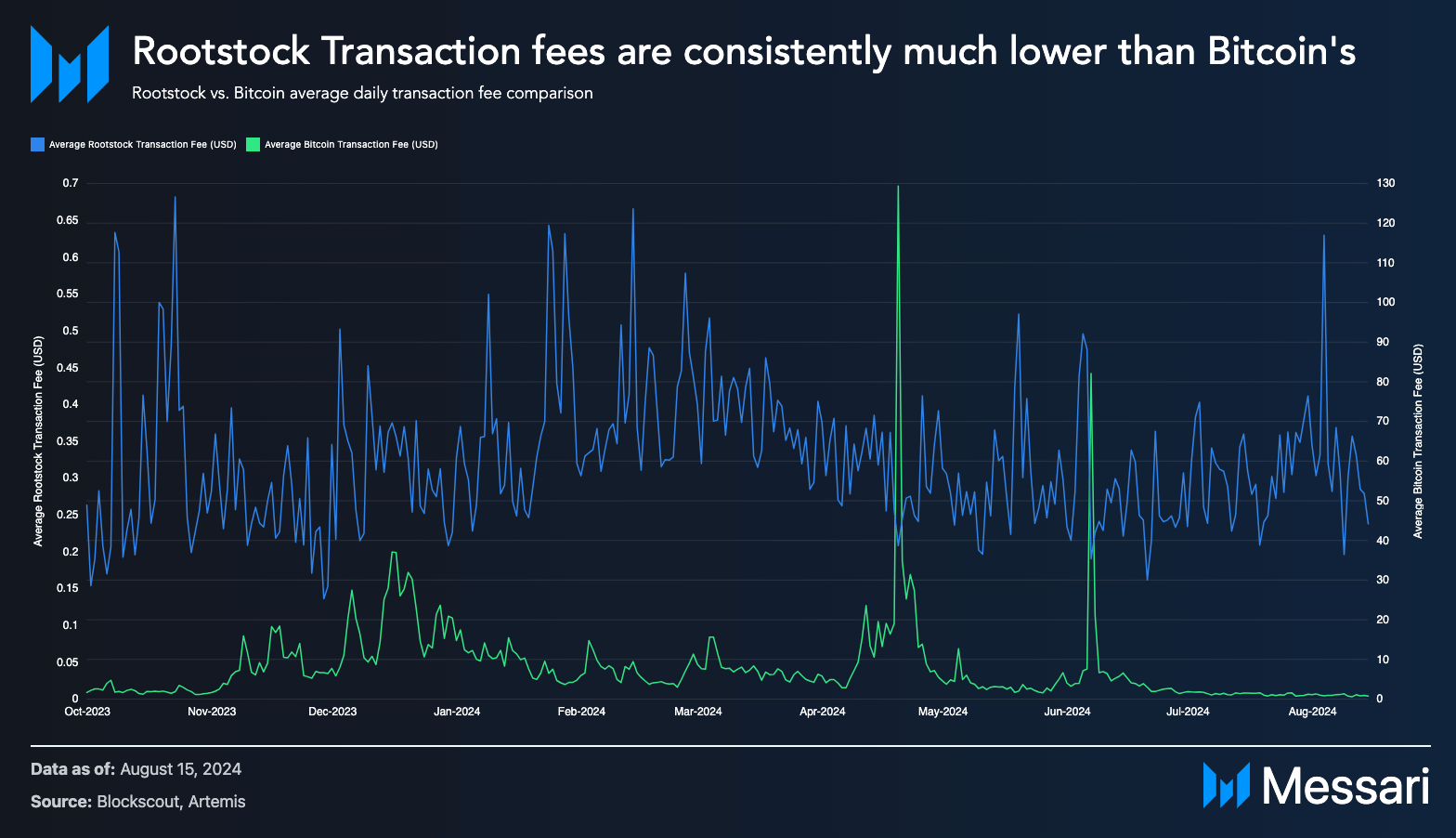

The report goes on to reveal how Rootstock is tackling some of the biggest pain points that exist with Bitcoin. While a new BTC block is created every 10 minutes — slowing down transactions — Rootstock’s average stands at a mere 30 seconds. As Messari’s charts show, this ends up having a real impact on end users.

“Over the past year, Rootstock transaction fees have remained significantly lower than the average daily transaction fees on the Bitcoin blockchain, with the average Bitcoin transaction fee being $7.86 compared to Rootstock’s average fee of $0.32 during the same period,” Messari adds.

Another challenge that has faced Bitcoin, especially when bull markets come around, is that these costs can be exceedingly volatile. Messari says BTC transaction fees have been 16.5 times higher than the norm at certain points of this year — reaching an eye-watering peak of $129.35 at one point. By contrast, Rootstock’s fees hit just $0.68, a mere 2.1 times higher than where they usually are.

Defense in Depth

Special attention is also given to the PowPeg bridging system that’s used to connect Bitcoin and Rootstock — enabling conversions to be made. Messari notes this allows BTC to be securely locked on its original blockchain while an equivalent amount is minted on Rootstock. The system is governed by respected entities that run specialized nodes, with emergency mechanisms, called “Defense in Depth”, in place in the event of hardware device failures or external threats.

Rootstock’s Role in Solving Real-World Problems

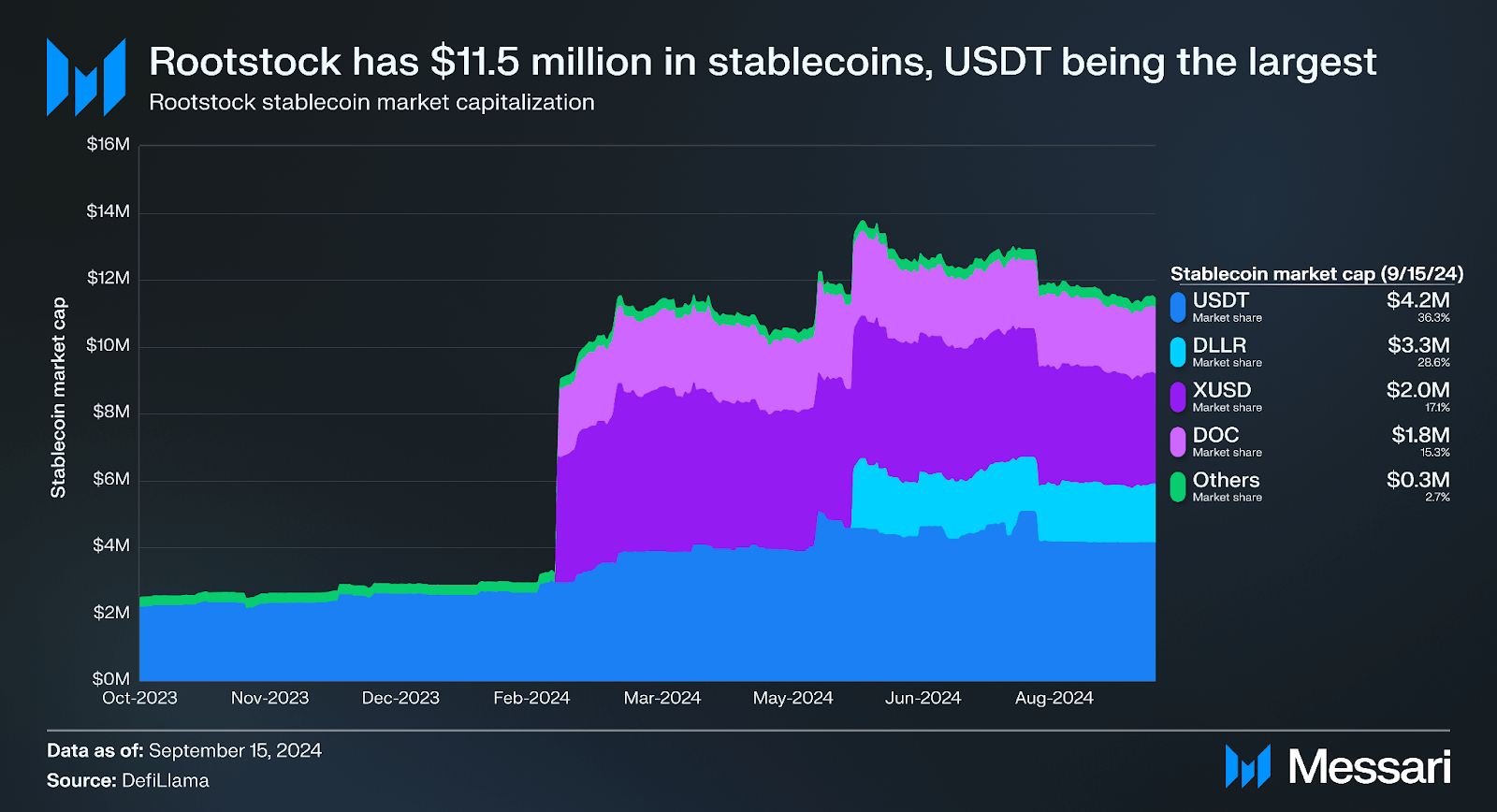

The report highlights how Rootstock is home to DeFi protocols that could never exist on Bitcoin owing to its technological limitations — as well as “a variety of well-established stablecoins.” There’s plenty of praise too for “interesting projects” that have been built within the ecosystem. Shoutouts were given to Tropykus, which offers savings in loans and dollars for Latin American consumers. Rubic — which aggregates over 80 blockchains and 220 decentralized exchanges to facilitate crypto swaps — also gets a mention. Buenbit’s role in making crypto investments more accessible to everyday users across the LATAM region was praised too.

All of this is a nod to how important it is for blockchains to offer simplified user interfaces and dApps that will be beneficial to the public — and superior to the fiat-focused solutions currently on offer. Given the levels of inflation in pockets of Latin America, and the high cost of remittances, inexpensive transfers and wealth preservation are vital use cases.

Of course, decentralization is vital to the health of blockchains. To that end, Messari highlights the newly launched RootstockCollective — a decentralized autonomous organization that allows RIF holders to stake their tokens and vote on matters affecting the future direction of the project.

Ecosystem Growth: Looking Forward

The research goes on to argue that Bitcoin programmability has become a hot-button topic in recent months — as proven by the rise in scalability solutions and the popularity of Ordinals and Runes, where data can be inscribed onto individual satoshis. Although there is increased competition in the landscape, Rootstock’s size and longevity stand out — especially considering it has been striving to innovate the Bitcoin ecosystem since the launch of Ethereum.

Looking forward, Messari argues that Rootstock has opportunities to enjoy further success through upgrades that are in the pipeline. Integrating the Flyover Protocol opens the door to faster transfers between BTC and RBTC in what is now called Fast Mode, while the addition of the Lightning Network to pegging in and out will give end users greater choice.

Later this year, a Bitcoin Native Assets Bridge is also planned that will allow Runes assets to be transferred into Rootstock. Other proposals would reduce this network’s confirmation time to just five seconds per block, all while delivering faster transaction throughput and slashing peg-out fees by up to 70%.

“With its founding scientist deeply involved in the development of Ethereum and a team dedicated to advancing programmability since 2018, RootstockLabs could potentially be in a position to support the needs and evolution of Bitcoin layers,” Messari concludes.