The Math Behind Bitcoin Halving: How the Process Works

Bitcoin’s limited supply is a fundamental aspect of its design and a key differentiator from government-issued currencies. Unlike centralized currencies, which are controlled by central banks and can be inflated at will, Bitcoin’s supply is predetermined and fixed at 21 million units.

This scarcity mechanism is intended to promote price stability and prevent excessive inflation, similar to the way gold’s limited supply has historically stabilized its value.

In this article, we explore the mathematical foundations of Bitcoin halving and how it reduces price inflation over time.

But first,

What is Bitcoin halving?

Bitcoin halving is a process that happens roughly every 4 years where the reward for mining Bitcoin is cut in half. This halving process reduces the rate at which new coins are created and added to the Bitcoin supply, thus, much like fiat currency, lowers the inflation rate.

The next halving is expected to occur in early-to-mid 2024, when the block reward will fall from 6.25 to 3.125 BTC.

The Importance and Effects of Bitcoin Halving

Miners are individuals or organizations that use specialized computers, called ASICs, to solve complex mathematical problems to validate and add new blocks to the Bitcoin blockchain. As a reward for their energy and time-consuming activity, miners receive newly minted Bitcoin.

“The steady addition of a constant amount of new coins is analogous to gold miners expending resources to add gold to circulation. In our case, it is CPU time and electricity that is expended.” – Satoshi Nakamoto, Bitcoin Whitepaper

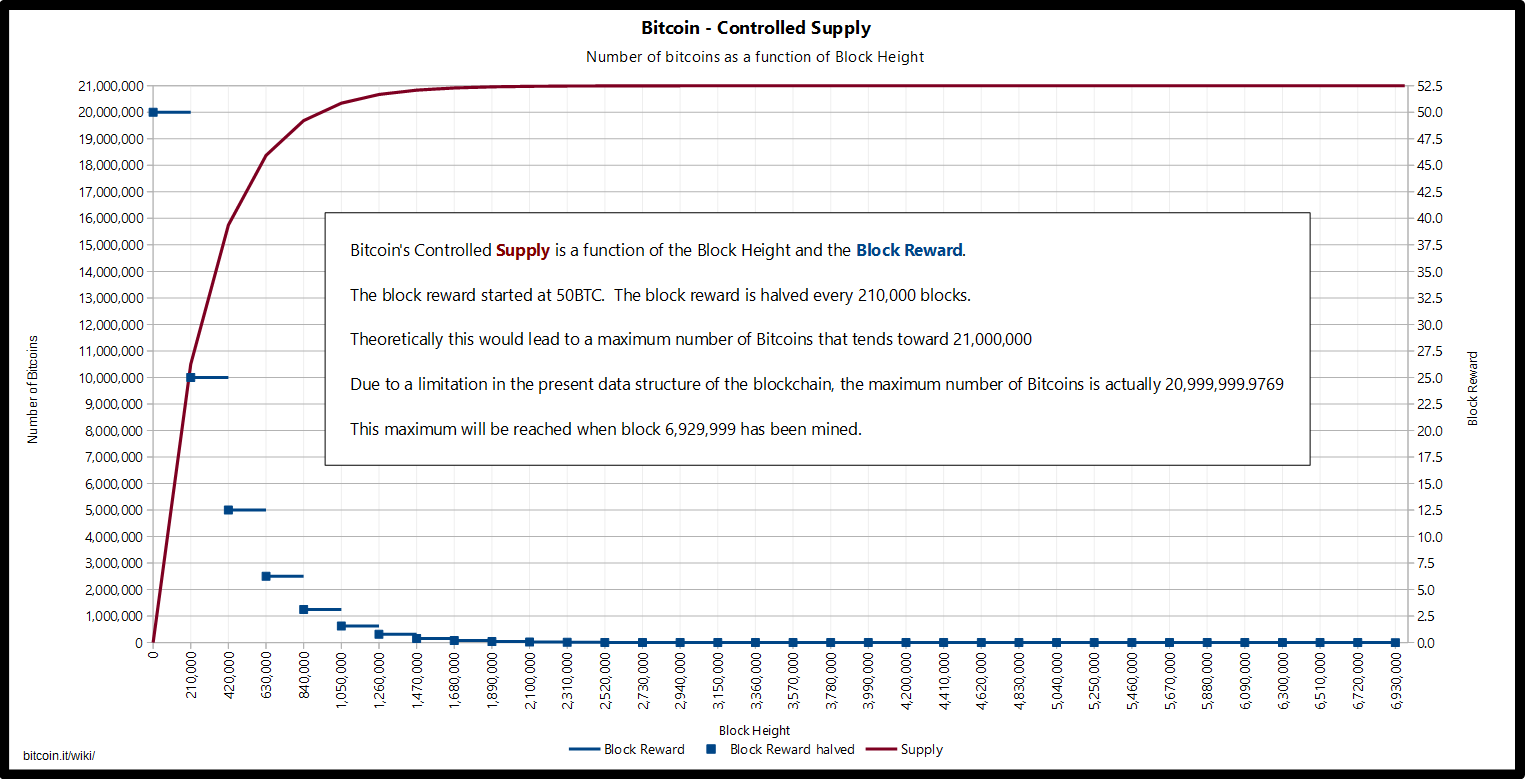

The rate at which new Bitcoins are created decreases geometrically over time. This means that the supply of Bitcoin mining rewards halves every 210,000 blocks. The halving is a built-in feature of the Bitcoin protocol and is intended to gradually reduce the rate of inflation over time.

Chart of new Bitcoin issuance over time. Source: Wikipedia

Understanding the Bitcoin halving formula

The formula that dictates how many Bitcoins are rewarded in each block. Source: Wikipedia

The above formula calculates how many bitcoin is created in each block. In the formula:

- Σi=032 = Sum of the total bitcoin reward of each of the total 33 halving cycles (it’s not 32 because the count starts from 0, not 1), counting starting from 0 (i = 0) up to 32

- 210,000 = Number of blocks to mine before the reward is halved (reward era duration expressed in blocks)

- 50 = Starting point value of the bitcoin reward per block mined

- 2 = halving factor

The mathematical formula that governs the halving relates the time period of each “reward era”, expressed in the number of blocks to be mined (210,000), and the number of Bitcoins assigned as a reward for each block mined.

The reward corresponding to the first “reward era”, which ran from 01/03/2009 to 11/28/2012, interpretable as the reward’s “starting point”, was 50 bitcoin per mined block.

This value appears on the right side of the formula, between square brackets.

Therefore the total amount of bitcoin generated, or total mining reward, of the first era corresponds to 210,000 * 50 = 10,500,000 BTC.

The number 108, which appears both in the part between square brackets and as the denominator of the entire formula, indicates the number of satoshis (sats) in a bitcoin.

sats are the smallest unit of bitcoin.

In other words, the exponent 8 in 108 is the number of decimal places of each bitcoin, i.e. 8 digits after the decimal point (1 sats = 0.00000001 BTC).

Multiplying the value of the reward, which is 50 in the i era, by 108 tells us how many sats the reward is equivalent to, i.e. 50 * 108 sats, or 5,000,000,000 sats per block.

The other 108, used as the denominator of the entire formula, serves to express the value of the reward back to Bitcoin, in fact 5,000,000,000 sats / 108 = 50 BTC.

The number 108 is used to mathematically establish how much a satoshi, the smallest unit of bitcoin, is worth, that is 1 BTC / 108, or 0.00000001 BTC.

The number 2 between the square brackets indicates the decrease factor. At each era the reward is halved, in other words divided by two.

In the first era, the exponent “i” of 2i equals 0. In the second era “i” is equal to 1. In the third i is equal to 2, and so on…

This exponent “i” increases by one with each era, i.e. every 210,000 blocks mined.

Indeed:

50 BTC / 20 = 50 (First era),

50 BTC / 21 = 25 (Second era),

50 BTC / 22 = 12.50 (Third era)

…

And so on until the 33rd and final era, set at the apex of the Sigma Σ symbol to the left of the formula.

The symbol Σi=032 is equivalent to a summation, which is repeated for the number of times reported at its superscript (32), and which count starts from the number reported at the subscript (i = 0).

It is a sum of the numbers resulting from the application of the formula in its entirety for every value of “i”, from 0 to 32.

So:

First era total reward = (210,000 * [(50 * 108) / 20]) / 108

+

Second era total reward = (210,000 * [(50 * 108) / 21]) / 108

+

Third era total reward = (210,000 * [(50 * 108) / 22]) / 108

+

…

+

Thirty-third era total reward = (210,000 * [(50 * 108) / 232]) / 108

= Total bitcoin supply = 21,000,000

Therefore, 21 million is the total supply of bitcoin.

Thus the halving algorithm also determines that there can never be more than 21 million bitcoin in circulation. The number 21,000,000 itself is not mentioned in Bitcoin’s code, but comes from the application of this algorithm, starting from those initial values.

How Does Halving Impact Bitcoin Miners?

As block rewards will halve, miners will receive half the amount of BTC for validating a transaction on the blockchain. Therefore, many miners will consider modifying their operations to sustain their profitability.

However, the price of Bitcoin has been consistently increasing, thus the decline in the number of BTCs received may end up being offset by an increase in cash value.

Learn more about how halving impacts Bitcoin miners and merged mining in this article.

What’s next

Bitcoin’s limited supply promotes price stability and long-term value preservation. A fixed supply prevents excessive inflation, which can erode the purchasing power of currencies and lead to economic instability.

As we anticipate the next halving and its subsequent effects, the principles embedded in Bitcoin’s design continue to shape its trajectory as a decentralized and deflationary currency.

“Please note: The views expressed in this article are the personal opinions of the author, and do not reflect the opinions of IOV Labs or its affiliated companies.”